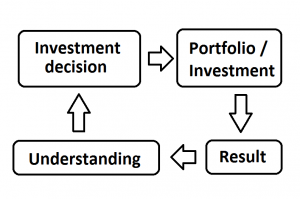

Lesson 004 – EPS. What can be easier?

This is our investing lesson #4 and the first true fundamental investing lesson.

Many investors should admit: “All what I know about investments I know due to Warren Buffett”. Me too. A lot of things I picked up from Oracle Of Omaha is simple but powerful stuff. Today we are going to talk about probably the most important thing you should know about company’s fundamentals.

Let’s get started!

EPS – The most Fundamental Criterion

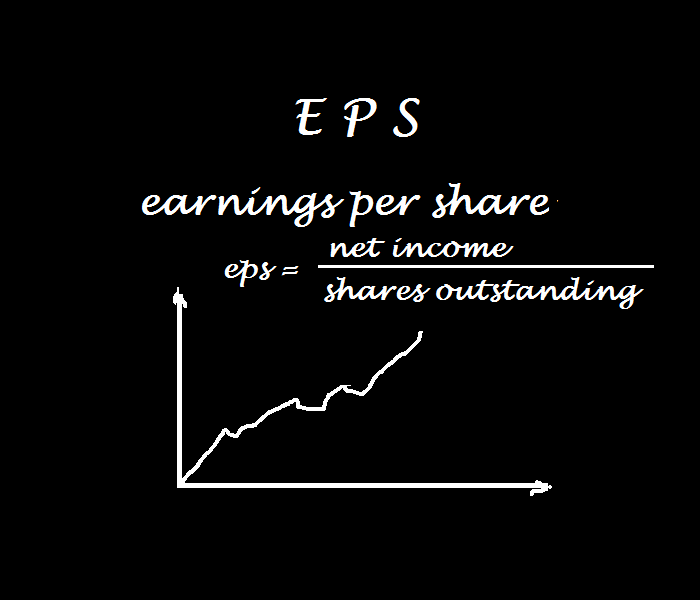

If you were allowed to look at just one kind of the company’s statistics and right after that to make a decision whether it is good or bad fundamentally, you should prefer to use the company’s EPS. This is probably the most fundamental one of all the fundamental criteria.

EPS Criterion

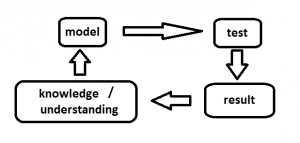

The idea is very simple: the company is good if its future profits are predictable. Provided, of course, that they are positive and growing. And EPS growth reflects the growth of the profits. Sounds simple? Don’t rush to answer. The following discussion is about the niggles and caveats about it.

Not All Earnings Are Equal

Just an example, a company X has sold one of its businesses. The money they get from this deal will increase profits of the company for this year. This is an example of non-recurring event which boosts net income. But only for one year with a possible negative impact on the future earnings (since the company got rid of the business, the business will not generate profits in future anymore). As opposed to that, a company Y has re-invested retained earnings into the core business, which resulted in 10% growth of profits this year. And highly likely this growth is here to stay in future. You as an investor, which company you would prefer – X or Y?

Detrimental Buybacks

There are some cases when the management wants to mask the fact the business is actually getting worse and worse. They know that investors look at earnings per share. So, even though net profits are lower and lower, smart management starts repurchasing company’s shares. Less shares outstanding – the higher EPS. I.e. if they buy back enough stock, the EPS will still look okay. Beware of smart management!

In one of the following lessons we are going to cover this in more details.

EPS Growth Rate

If a company satisfies the criterion regarding EPS, you can calculate an annual EPS Growth Rate. There are couple of things to know about it:

- Its normal average value varies significantly depending on sector and industry;

- If you have two companies from the same industry, you should choose the one with higher EPS growth rate, all else being equal;

- It is very difficult for any business to maintain annual growth of more than 20%. If you see a higher value, it is recommended to cap it at 20% in your calculations.

And one more thing – as in any standard disclaimer: remember, past performance does not guarantee anything in future.

You need 10 years of statistics

This heading speaks for itself. To make any more or less reliable conclusions regarding any fundamental ratio (EPS in particular), you need a decade of statistics. I would not recommend you to use statistics for less that 7 and more than 10 years – your calculations and conclusions in both cases tend to be inadequate.

A Practical Problem

The problem is very simple: how to practically use this criterion? Yes, of course, anybody can glance at 10 financial statements of a company, skimming just earnings per share values and then apply this criterion, right? But in practice such thing is way harder: if you go to Google Finance, Yahoo Finance, MSN or any other free source, you will find the data for just 4 years. By the way, MSN used to have it, but after they redesigned the UI couple of years ago, it is gone…

As of now, I can recommend just couple of sources of such information – both are paid services – Morningstar and Black Belt Investments.

Outliers

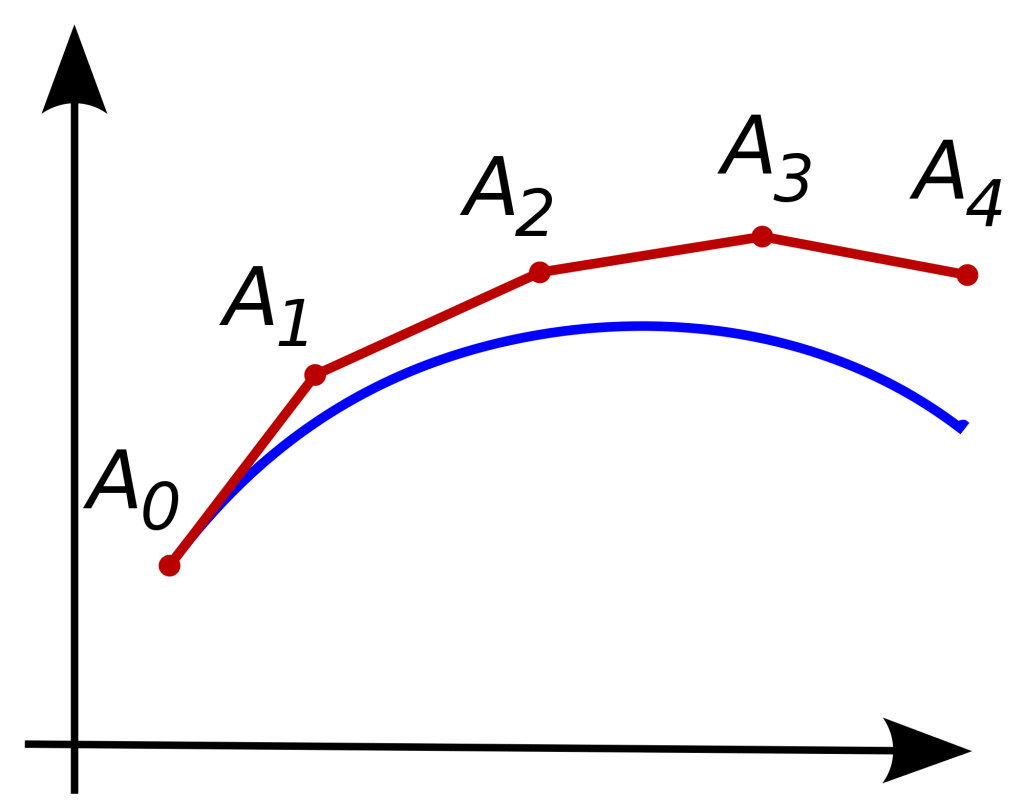

Above we already spoke about non-recurring (one-time) events. They are not limited to just a sale of assets, they also include accidents, natural disasters, any kind of one-time abnormal situation around business. They tend to generate abnormally low or high value of EPS – outliers. There are different techniques how to cope with them (for example, you can get rid of maximum and minimum values or you can straighten it by spline functions – in further lessons we may touch this). The only important thing here is: you cannot ignore outliers.

Baby Buffett Portfolio

Named after Warren Buffett, it is just a set of his best long-term investments. We will need it, because we will refer to them quite often in our problems. Here is the Baby Buffett Portfolio:

- Nike Inc

- ConocoPhillips

- Costco

- The Coca-Cola Company

- Procter & Gamble

Problem #5: There was one more company in Baby Buffett Portfolio: Burlington Northern Santa Fe Corp. Please find out what has happened to this company.

Problem #6: Please apply the EPS Criterion to all the companies in the Baby Buffett Portfolio.